The concept of dual residence crucially affects taxation of non-resident Indians and individuals who travel frequently between India and other countries. India follows a residence-based taxation system for residents, i.e., an Indian resident is taxed on his global income. A non-resident is taxed on income which is sourced or accrued or received in India.

However, the confusion arises when an individual leaves the country and starts residing in another country under the laws of which he also becomes a resident in that other country in that year. Thus, the individual may become a ‘dual resident’ for tax purposes. Taxation of dual residents is resolved either under local laws or when there is a Double Taxation Avoidance Agreement (DTAA) executed between the two jurisdictions of which they are residents, through application of the tie breaker clause in the DTAA.

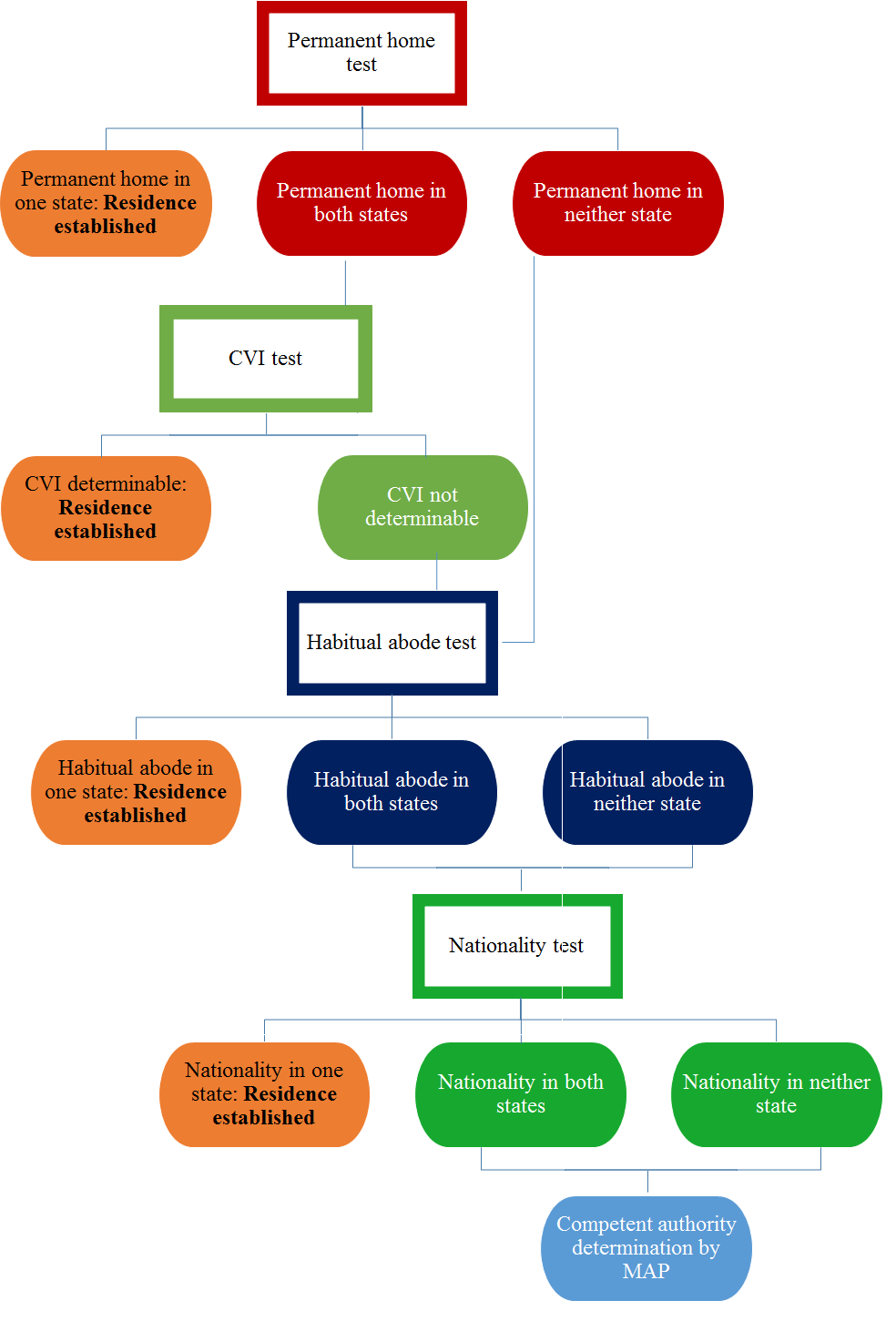

Typically, Article 4 of a DTAA deals with residence of taxpayers. Article 4(2) sets out the tie-breaker tests for determination of jurisdiction of taxation when an individual is a resident of two jurisdictions. The decision on residence must follow the sequence of tests envisaged under Article 4(2). The chart below describes how each of the tests is to be applied. In addition, each test must be conducted based on the facts of each case.

Recently, the Bangalore ITAT in the case of Shri Kumar Sanjeev Rajan,[1] applied the tests in the manner and order contemplated under Article 4(2) of the India-US DTAA and concluded that the assessee was a resident of the USA during the year in question.

The assessee and his family members were citizens of the USA. The assessee had been living and working in the USA for nearly 20 years until he was deployed on a temporary cross-border assignment in India for six years. He completed his assignment in India in August 2012 and moved back to the USA upon completion of the assignment. The question that arose for consideration of the Assessing Officer (AO) was in regard to the taxability of income earned by the assessee in the year 2012-2013.

Under Section 6 of the Indian Income-tax Act, 1961 (IT Act), an individual is considered a ‘resident’ of India if:

The AO found that the assessee satisfied the second residence criterion in the year 2012-2013. However, the assessee also qualified as a resident of the USA as per domestic tax laws of that country. Therefore, the AO sought guidance from the rules under Article 4(2) of the India-USA DTAA. Although the assessee’s house property in the USA was let out during his Indian assignment, post August 2012, he had a permanent home in both India as well as the USA. Thereafter, the AO applied the centre of vital interests (CVI) test as per the sequence of tests set out under Article 4(2).

Under this test, the individual is deemed to be the resident of the country with which he has closer personal and economic relations. The AO was of the opinion that ‘personal and economic interests’ refers to a “long and continuous relation” nurtured by an individual with a country and cannot be broken forthwith upon relocation to another country. The AO held that the assessee was an Indian resident for the entirety of the year 2011-2012, and such residence does not fluctuate with the assessee moving to the USA for less than eight months in the year 2012-2013.

Separately, the AO also recorded that Indian law does not recognise split residency, i.e., the tax year is not split such that income during the first four months of 2012-2013 is taxed in India and the rest in the USA. The AO went on to tax the income received by the assessee in 2012-2013 as per the IT Act.

On appeal, the Commissioner of Income Tax (Appeals) (CIT(A)) overturned the adverse assessment order and held that the assessee’s CVI was closer to the USA than to India on a consideration of the following factual points:

Accordingly, the CIT(A) set aside the assessment order of the AO. Aggrieved by the decision of the CIT(A), the revenue filed an appeal before the ITAT. The ITAT ruled that the CIT(A) had rightly applied the CVI test and arrived at the conclusion that the assessee’s CVI was closer to the USA than to India, on the basis of facts and supporting evidence presented by the assessee. Accordingly, the ITAT did not interfere with the order.

In sum, the ITAT and the CIT(A) have rectified the revenue’s belief that the CVI cannot change abruptly within the financial year. The AO supported the conclusion of the assessee’s Indian residence based on the fact that the assessee’s residence during the year preceding the year in question was Indian. The AO justified this reasoning on the basis that the economic and personal relationship has to be analysed holistically and not in a compartmentalised manner. However, the final orders of the ITAT and the CIT(A) evince that residence in prior years is of no relevance and each assessment year is to be viewed separately. Further even within the same financial year, if the taxpayer spent an initial few months in India, his residence was subject to change based on a shift in the CVI, i.e., the CVI can indeed fluctuate overnight.

Considering today’s global commercial scenario, individuals are often required to move between countries either permanently or temporarily and are therefore vulnerable to the risk of being entrapped in dual residency. The test of residence under Article 4(2) must be ascertained only through analysis of evidence produced by the taxpayer. While the chronology of tests is laid down in the DTAA, there does remain an element of subjectivity with regard to the CVI. While this order of the ITAT provides guidance in this regard, since the factual background of each individual would vary widely, we strongly urge that you consult with tax or legal experts if faced with a dual residence conundrum upon relocating to a different country.

[1] (2019) 104 taxmann.com 183 (Bang-trib.).